Executive Summary – IPAY

(Launched by IPV Surakshaa Kawach Charitable Trust, Reg. No. 2025/22/IV/1638)

About IPAY

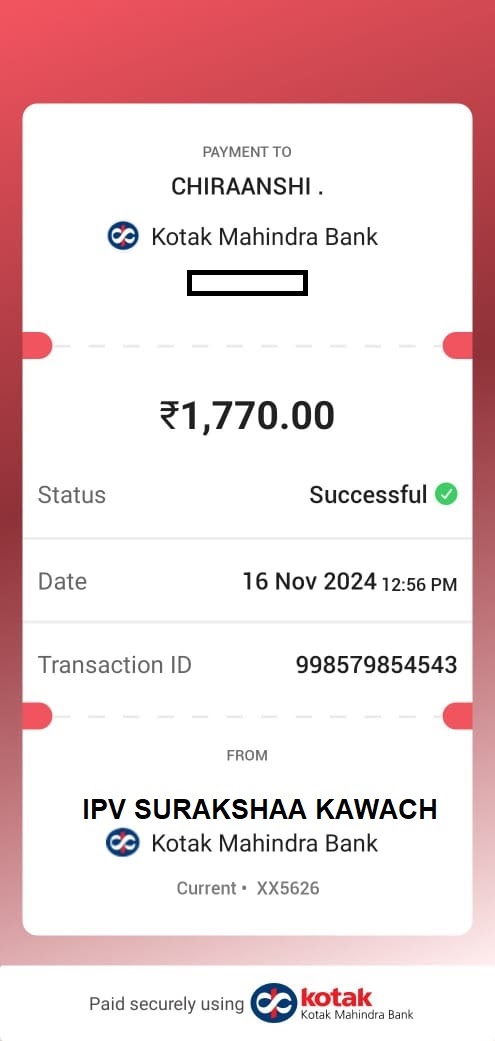

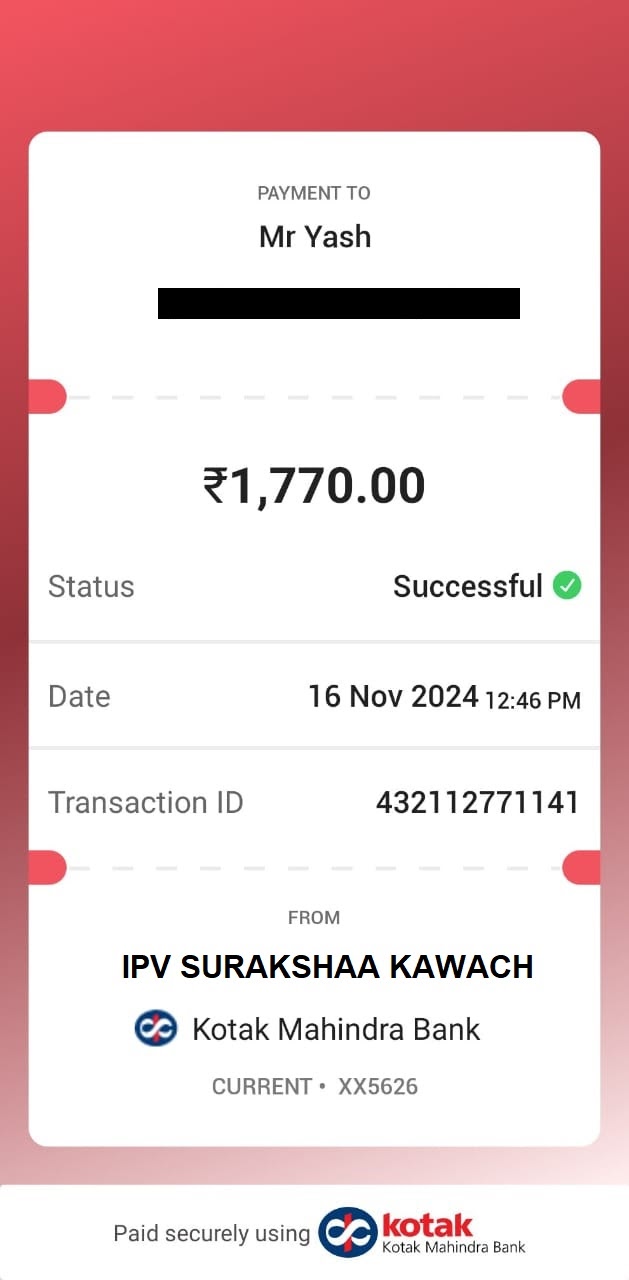

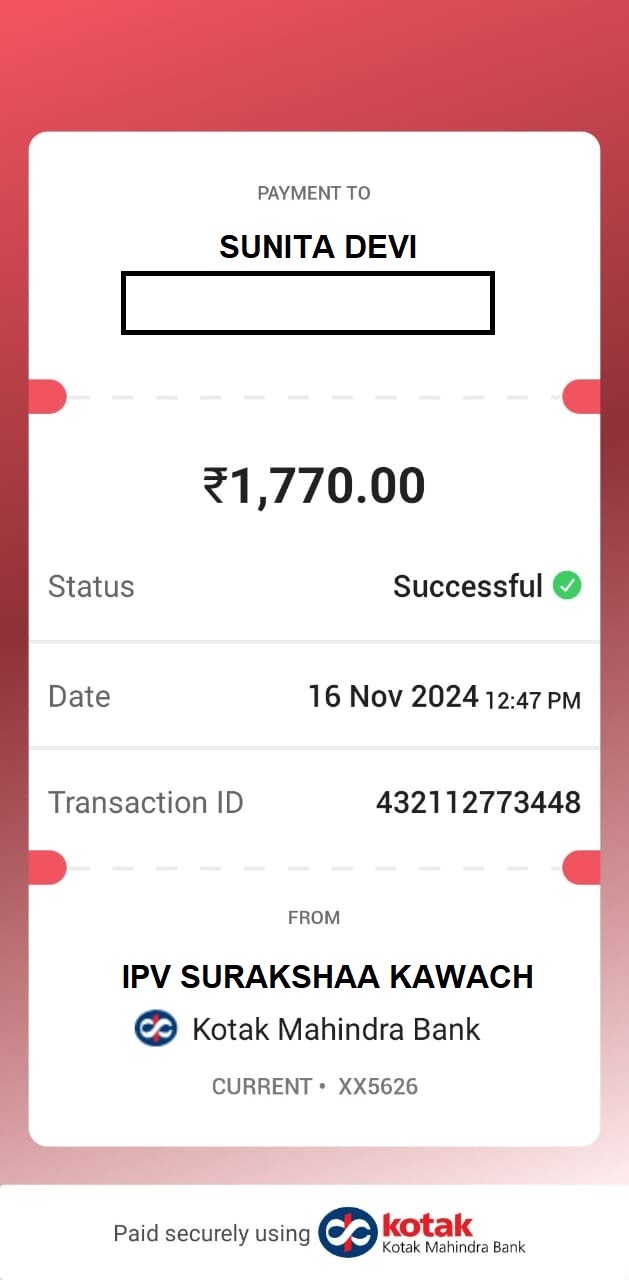

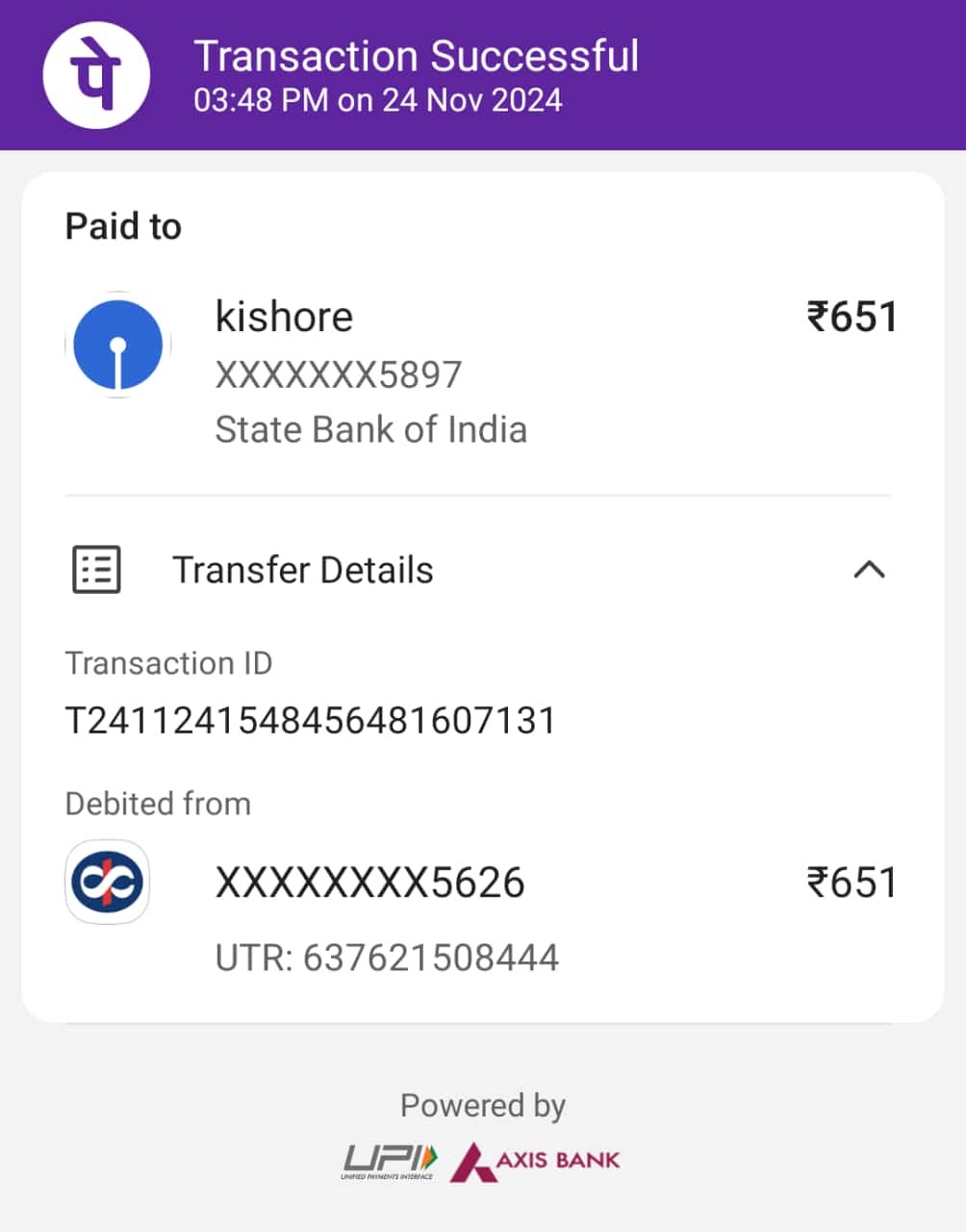

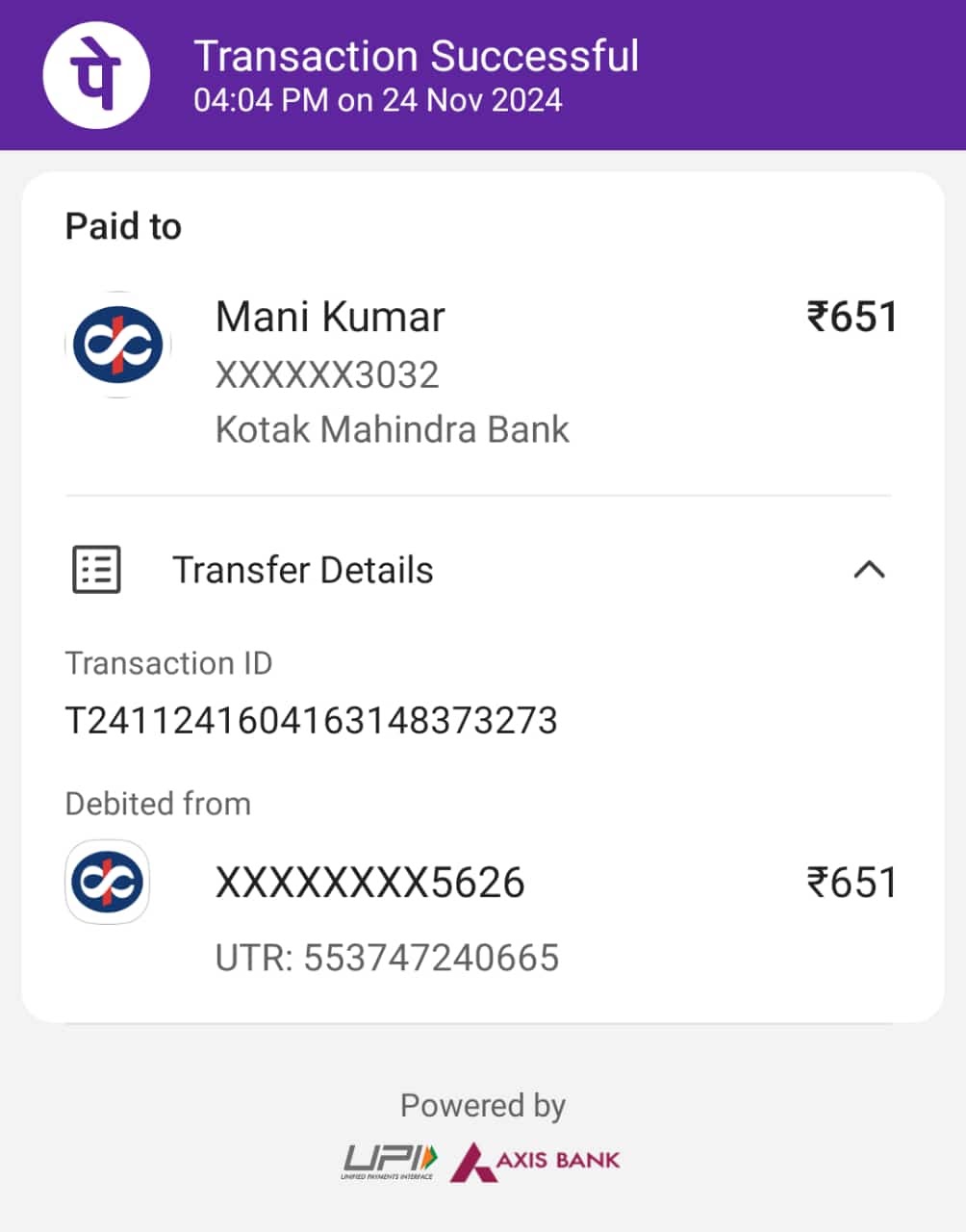

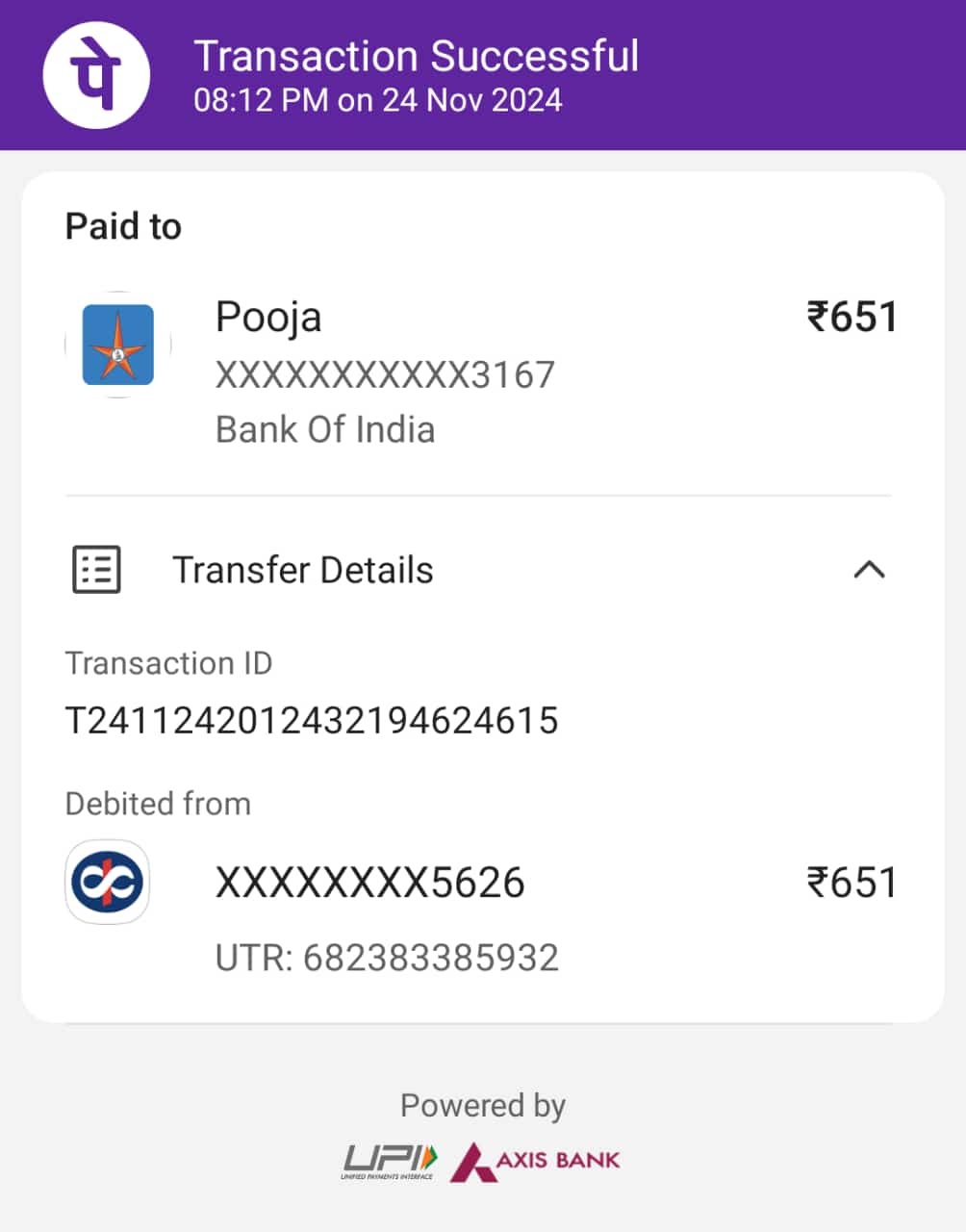

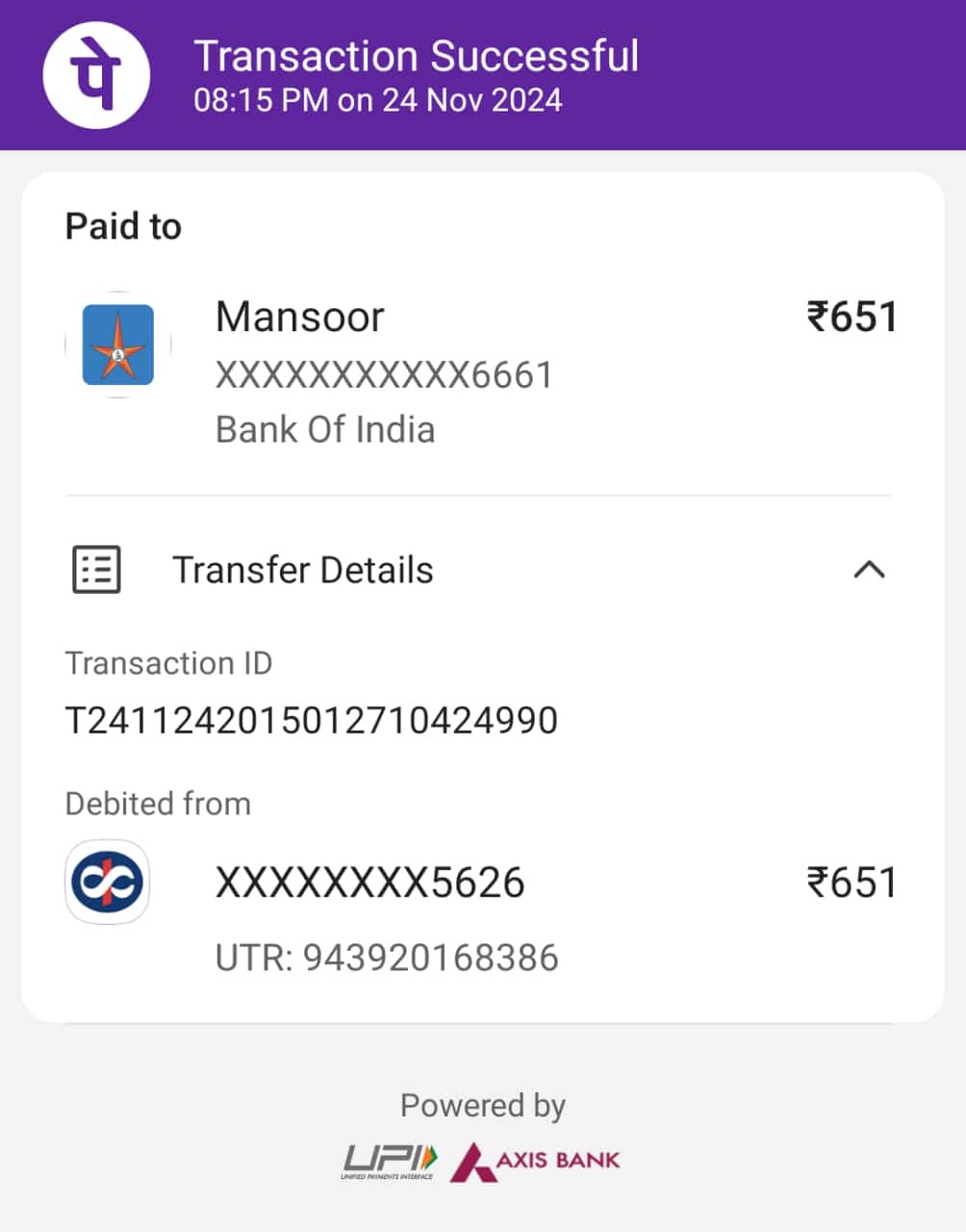

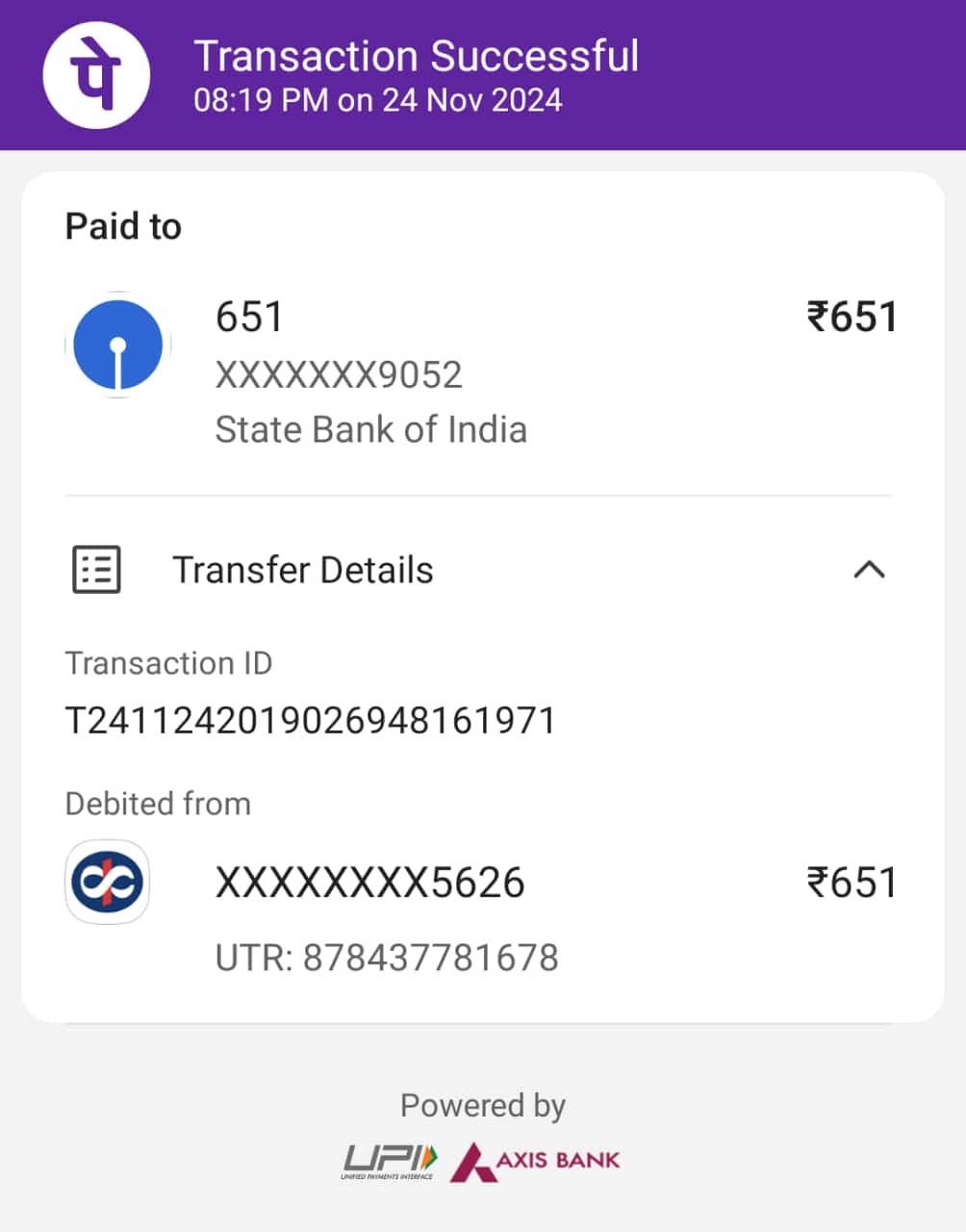

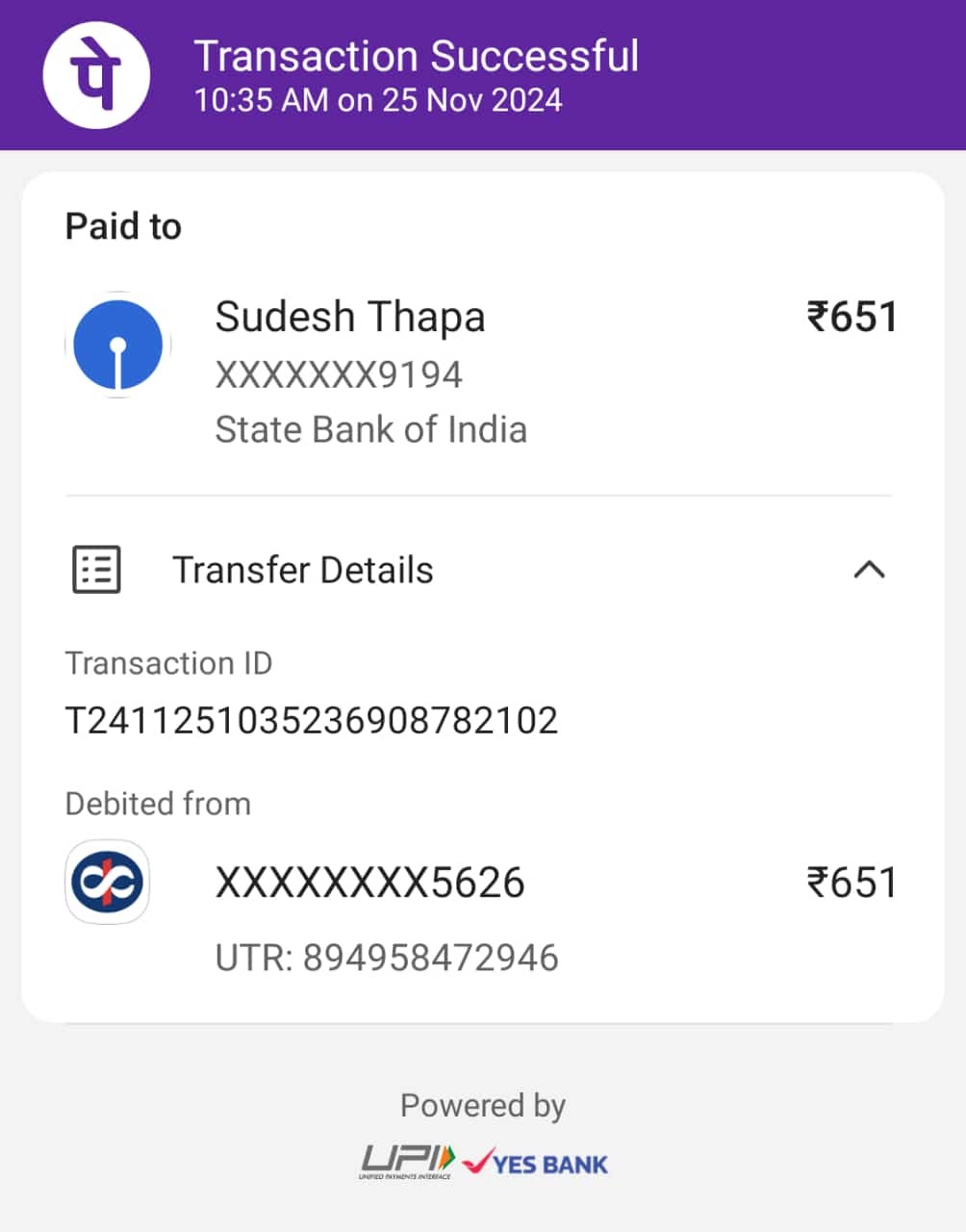

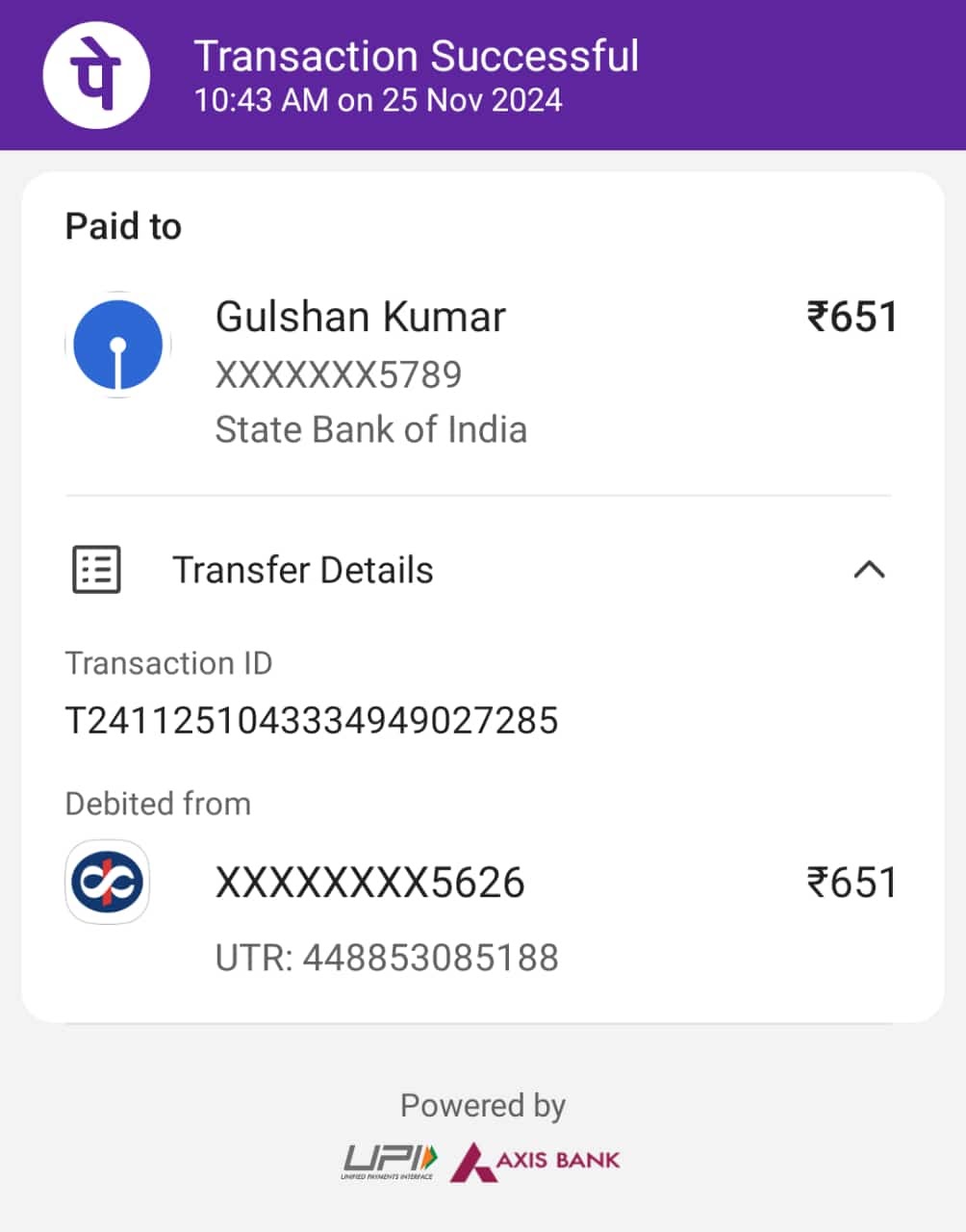

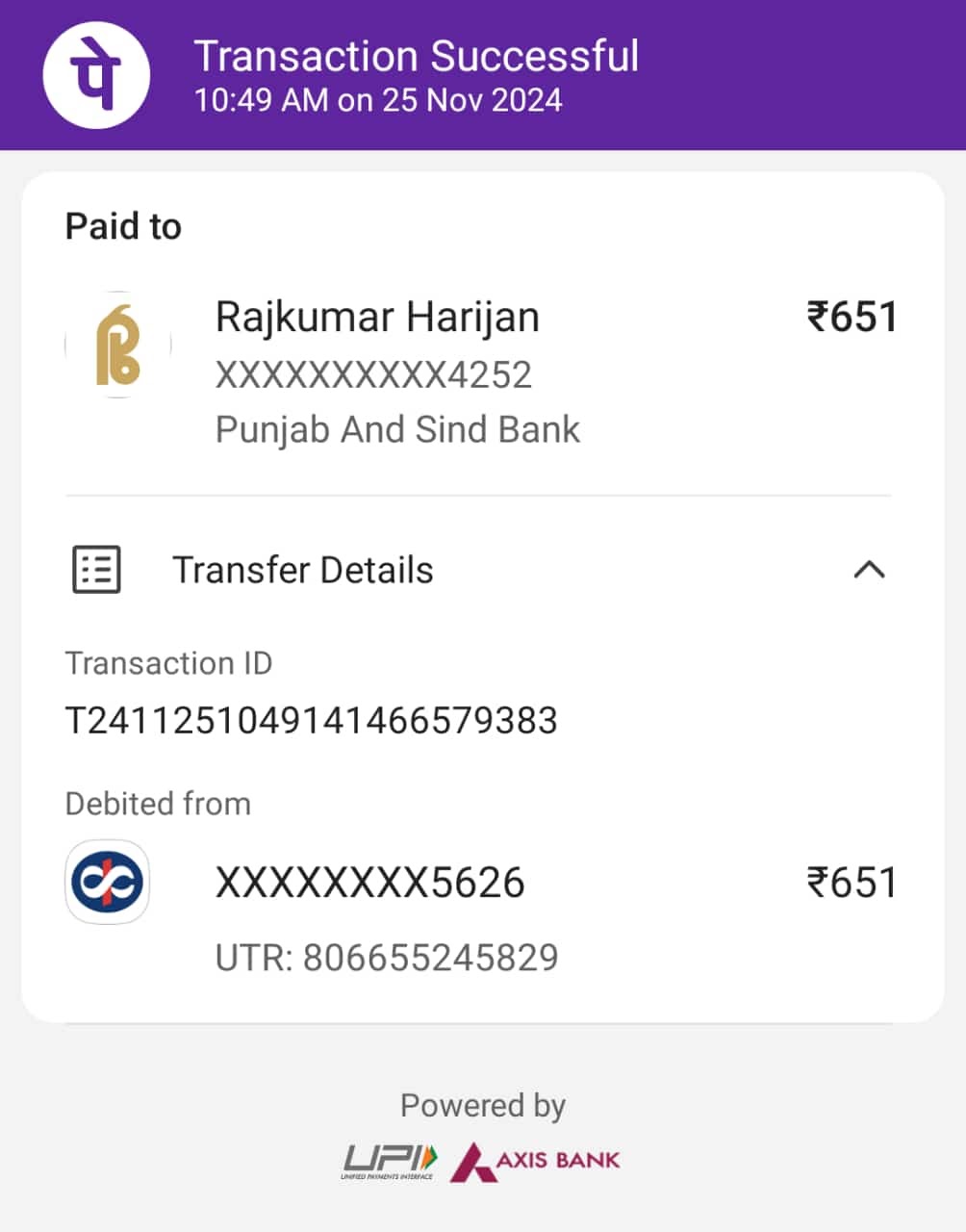

IPAY is a complete Indian digital payment and compliance platform designed to empower individuals, merchants, and corporates with secure, fast, and GST-compliant financial transactions. Developed under the IPV Surakshaa Kawach Charitable Trust, IPAY integrates UPI, BBPS, GST Billing, and C2C and merchant payments into a single ecosystem.

Vision

To make digital transactions seamless, transparent, and compliant for every Indian, from a student to a shopkeeper, and from households to corporates.

Vision Statement: Har Bharatiya Ke Liye Surakshit Aur Saral Digital Bhugtaan

Core Services

-

C2C Payments

Wallet-based money transfer services include send, receive, and withdraw. -

Merchant Solutions

QR-based payments, GST-integrated billing, and instant settlements. -

BBPS Utility Payments

Electricity, gas, DTH, EMI, insurance, and mobile recharges. -

Compliance and Reporting

Auto GST reporting, tax reports, and audit-ready dashboards. -

Corporate Solutions (Phase 4)

Payroll processing, vendor payouts, and bulk disbursements.

Market Opportunity

India’s digital payment market is projected to cross USD 200 billion by 2030.

UPI dominance, with approximately 65 per cent market share, ensures growth potential.

A major gap exists in the market where payment, GST, compliance, and trust-backed social impact are combined. IPAY uniquely addresses this opportunity by offering a unified system supported by a trust-based model.

Budget (Year 1 – MVP Launch)

-

Development and Security: INR 2.4 Crore

-

Compliance and Licensing: INR 50 Lakh

-

Operations and Team: INR 1 Crore

-

Marketing and CSR-Based Branding: INR 70 Lakh

Total Investment Needed: INR 4.6 Crore

Revenue Streams

-

Merchant transaction fees

-

Subscription revenue for GST compliance tools

-

Commission from BBPS services such as utility bills, recharges, and EMI

-

Premium wallet-based services

Launch Roadmap (24 Months)

Phase 1: C2C Wallet and Payments (6 months)

Phase 2: Merchant and GST Billing (12 months)

Phase 3: BBPS and Utility Ecosystem (18 months)

Phase 4: Corporate Services and Advanced Compliance (24 months)

Impact and CSR Edge

IPAY will simplify digital transactions and also generate employment, support MSMEs, and promote financial literacy. Since it is backed by a charitable trust, the platform ensures profit with purpose, where revenue can be reinvested into social upliftment and public welfare projects.

Contact

IPV Surakshaa Kawach Charitable Trust

Mobile: +91-9654379155

Website: https://ipvsurakshaakawach.com

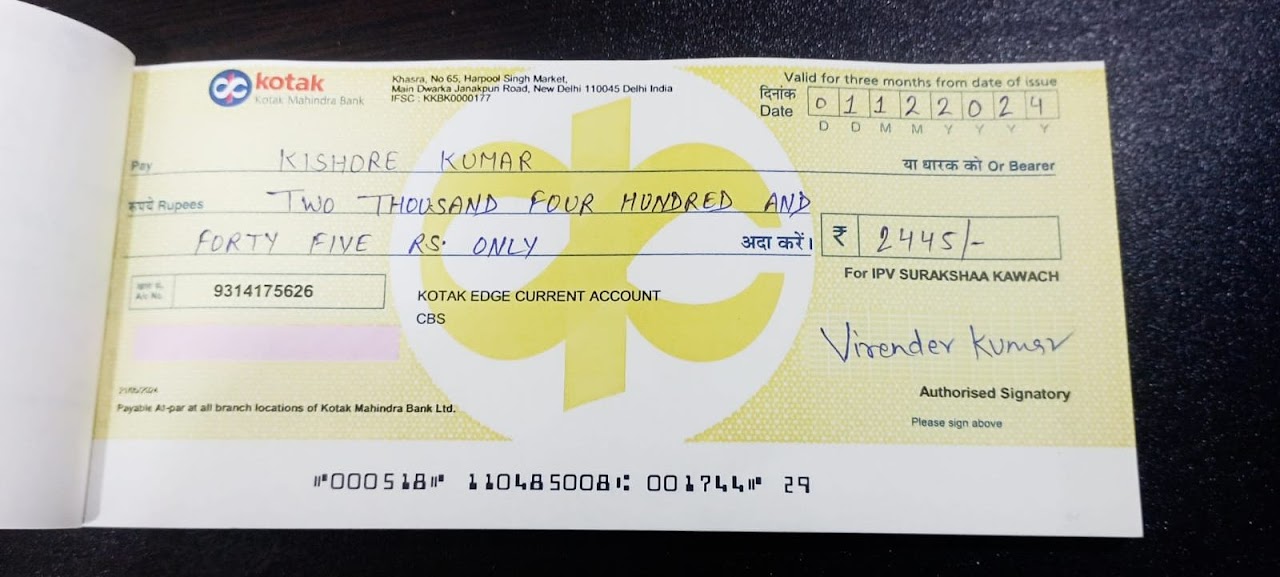

IPay — Project Report

Owner and Sponsor

IPV Surakshaa Kawach Charitable Trust (Reg. No. 2025/22/IV/1638)

Product Name

IPay Control (Web and Mobile)

Purpose

A Pan-India digital payment platform offering BBPS bill payment, peer-to-peer pay-in and pay-out, merchant payment receiving, and integrated billing software with GST invoicing and compliance linked to the merchant's GST number.

Contact

IPV Surakshaa Kawach Charitable Trust

Mobile: +91-9654379155

Website: https://ipvsurakshaakawach.com

1. Executive Summary (One Paragraph)

IPAY is a secure and partner-centric payments platform built for consumers and merchants across India through web and mobile access. Its core services include BBPS integration for utility and recurring bill payments, peer-to-peer transfers, merchant payment acceptance through QR and UPI via partners, and a GST-compliant billing module. The platform aims to serve MSMEs, households, and institutional partners. Instead of building issuer infrastructure internally, IPAY will operate as a regulated and scalable fintech ecosystem using strategic banking, NPCI, and BBPS partnerships.

2. Services and Features (Product Scope)

Customer-Facing Services (Web and Mobile)

-

BBPS Bill Payment

Pay utility bills and other recurring payments through an integrated BBPS aggregator with bill search, scheduled payments, and receipts. -

P2P Pay-in and Pay-out

Instant UPI and bank transfers for wallet top-ups and money transfers to contacts or bank accounts. -

Merchant Payments

Merchant payment acceptance via UPI QR and Bharat QR, card acceptance through acquiring partners, and checkout APIs for e-commerce. -

User Wallets and Reconciliation

Optional escrow and settlement accounts for pay-ins and pay-outs through partner banks. -

KYC and Onboarding

Aadhaar, PAN, and OTP-based KYC process through an authorised KYC partner. -

Security and Fraud Controls

Two-factor authentication, device risk scoring, transaction limits, and real-time monitoring aligned with RBI and PCI-DSS standards.

Merchant-Facing Services (Web Dashboard and Billing Software)

-

Billing Software (SaaS)

POS and invoicing system to generate GST-compliant invoices with merchant GSTIN, auto GST calculations, and e-invoice support where applicable. -

GST Reporting

Tracks GST collections and provides summaries for accountants, audits, and exports. -

Complaint and Ticketing Module

Linked complaint management for payment disputes. -

Settlement and Payout Management

Daily or weekly settlement cycles and reconciliation dashboard. -

Dispute and Complaint Management

Tracks complaints using transaction IDs and merchant GSTIN for audit trails.

3. Market Analysis (Summary and Key Points)

India’s digital payments market is rapidly growing, led by UPI and instant payments. This creates a strong opportunity for unified platforms offering bill payments, merchant acceptance, and simplified compliance. BBPS expansion supports recurring revenue and customer retention.

Why IPAY Control

-

Consumers prefer a single app for bill pay, wallet transfers, and merchant payments.

-

MSMEs need GST-aware billing and simple payment acceptance to reduce compliance burden.

-

Regulatory trends increase the demand for secure and compliant digital platforms.

Target Segments

-

Urban and semi-urban consumers

-

MSME merchants, including retail stores, clinics, and tuition centres

-

NBFC and bank partners seeking collections and channel reach

4. Regulatory and Compliance Overview (Must-Do)

-

RBI Compliance

Use NPCI and RBI-approved rails such as UPI, IMPS, and NEFT through partnerships. -

BBPS Membership

Integrate via an authorised BBPS aggregator or operate as a BBPOU partner. -

PCI-DSS Compliance

Prefer tokenisation via acquiring partners to reduce card-data scope. -

KYC and AML Compliance

Follow KYC and KYB requirements and AML monitoring under applicable laws. -

GST and E-Invoicing

Support GST-compliant invoices and e-invoice generation where required under law.

5. Technology and Integrations (High Level)

-

Frontend

React for web and React Native or native mobile development. -

Backend

Microservices architecture using Node.js, Java, or Python with PostgreSQL and event systems like Kafka. -

Payments Rails

UPI PSP partners, acquiring banks, and BBPS aggregator APIs. -

Billing and GST

GST calculations, HSN and SAC mapping, GSTIN validation, and e-invoice support. -

Security

Encryption, strong authentication, monitoring, and compliance readiness.

6. Business Model and Revenue Streams

-

Transaction Fees

Convenience fee or percentage per transaction. -

BBPS Commission

Commission share for bill payments. -

Merchant Subscription

Monthly or annual SaaS for billing and compliance tools. -

Value-Added Services

Loan referrals, analytics, and messaging charges.

7. Go-to-Market and Partnerships

Partnerships required include banks, payment gateways, acquiring partners, BBPS aggregators, KYC providers, e-invoicing providers, and cloud hosting.

Channels include MSME onboarding teams, digital marketing, business associations, and referral programs.

8. Risk Analysis and Mitigation

-

Regulatory changes

Maintain legal advisory and flexible architecture. -

Compliance complexity

Enable GST and e-invoicing support and educate merchants. -

Competition

Differentiate through the BBPS and GST billing focus. -

Fraud and chargebacks

Implement risk controls and monitoring systems.

9. Implementation Roadmap (High Level)

Phase 0: Planning and Partnerships (0–2 months)

Phase 1: MVP Development (3–6 months)

Phase 2: Feature Expansion (6–12 months)

Phase 3: Scale and Value Add (12–24 months)

10. Budget and Financials (Estimates)

MVP CapEx estimate: INR 62 lakh to INR 1.25 crore

Year 1 OpEx estimate: INR 61 lakh to INR 1.24 crore

Total Year 1 estimate: INR 1.23 crore to INR 2.49 crore

Scale build estimate (12–24 months): INR 3.5 crore to INR 8 crore

11. Revenue Example (Illustrative)

Example assumptions show potential for transaction fee and subscription revenue, with a typical fintech break-even expected between 18 and 36 months,s depending on acquisition cost and scale.

12. Key Success Metrics

-

GMV processed monthly

-

Active transactions per user

-

Merchant ARPU

-

CAC and onboarding costs

-

Fraud and chargeback rate

13. Next Steps (Recommended Actions)

-

Finalise BBPS aggregator and bank partnerships

-

Release RFP for development vendors

-

Appoint a compliance and legal advisor

-

Pilot launch in one region

-

Monitor RBI and NPCI security updates

12-Month Project Timeline and Hiring Plan (Summary)

Month 1–2: Foundation and Planning

Month 3–4: MVP Development Begins

Month 5–6: Core Integrations

Month 7: Alpha to Pilot

Month 8–9: Beta Expansion

Month 10: Scale Up